Thus, doesn’t make sense to invest into the iPod. This change in consumer behavior results in a shrinking market share. The market isn’t growing as people tend to use their phones to listen to music and podcasts these days.

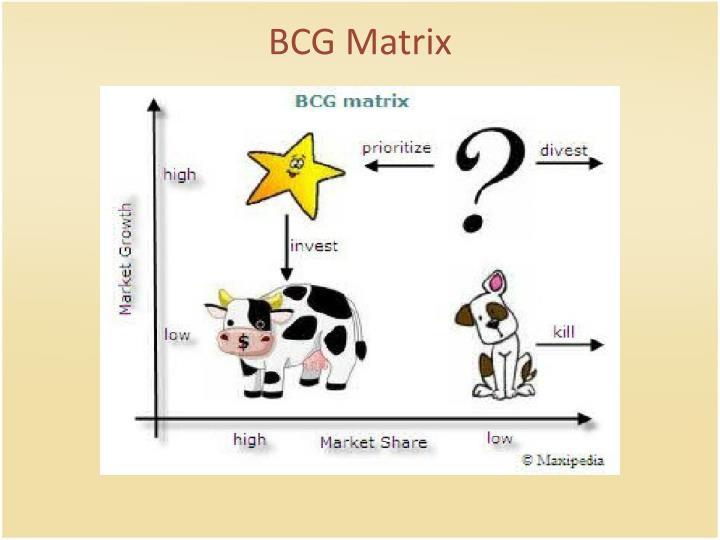

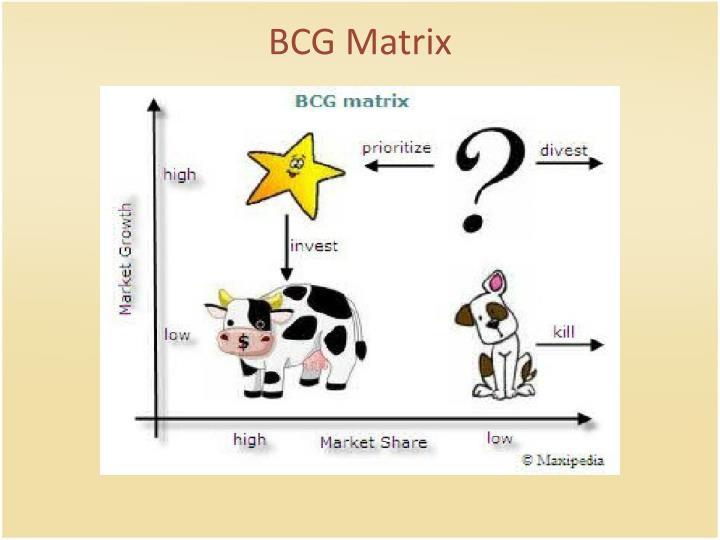

Dogs: The iPod is the dog of the portfolio. They require relatively little investment for them to continue to be profitable. These products have a high market share but the market for these products isn’t really growing anymore. Cash Cows: The iPad and MacBook are the cash cows of Apple’s product portfolio. The iPhone generates significant profit but still requires investment to transition to into tomorrow’s cash cow. It’s has a high market share in a market that is still growing. Stars: The iPhone is the star of Apple’s portfolio. You can see this portfolio mapped onto a Boston Matrix in the diagram below. By then determining a strategy for each individual product of either hold, divest, harvest, or build, the portfolio mix of a business can be maintained in a profitable combination, for the long-term.įor our example, we’re going to analyze Apple’s product portfolio. The BCG Matrix is a strategic tool to provide an initial screen of a businesses opportunities. These products might become stars, but equally, they might crash and burn as it’s not easy to spot a future star. Because of this their growth-rate going forward is unclear and further investigation is needed to decide what to do with these products. These are products with a low market share in a high-growth market. If a dog is profitable you should invest as little as possible into it, or even consider divesting it. If these products are not profitable you may wish to divest them or consider a red ocean strategy.

These are products with a low market share in low-growth markets. It is thus advisable for a business to invest in these products to maintain market leadership, thus securing future profits as the market continues to grow. These stars have the potential to provide a high proportion of the future profits of the business.

These are products with a high-market-share in a growth market. In a nutshell, we want to milk these products without killing the cow! 2. Cash Cows need to be milked for profits but given minimum investment. They are profitable, generating good margins, and throwing off excess cash without the need for significant investment. These are products with a high-market-share in a slow-growing market. This will result in each product of the portfolio falling into one of four categories: 1. Each product in a business will be assessed against both of these criteria and then placed into the matrix.

0 kommentar(er)

0 kommentar(er)